Agri Value Chain

Agri Value Chain - Definition

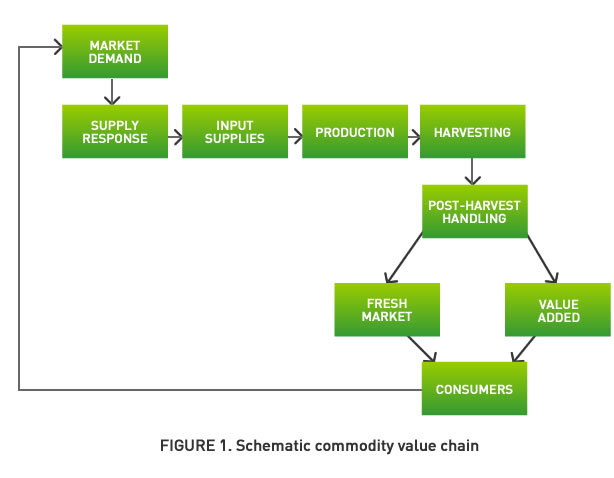

A ‘value chain’ in agriculture identifies the set of actors and activities

that bring a basic agricultural product from production in the field to final

consumption, where at each stage value is added to the product. A value

chain can be a vertical linking or a network between various independent

business organizations and can involve processing, packaging, storage,

transport and distribution. The terms “value chain” and “supply chain”

are often used interchangeably.

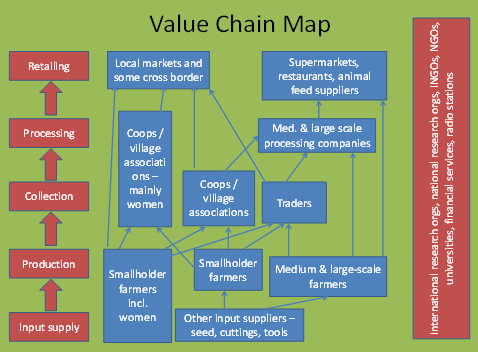

Traditional agricultural value chains are generally governed through spot market transactions involving a large number of small retailers and producers.

Modern value chains are characterized by vertical coordination,consolidation of the supply base, agro-industrial processing and use of standards throughout the chain.

Source: Adapted from FAO, 2005.

Value chains are a key framework for understanding how a product moves from the producer to the customer. The value chain perspective provides an important means to understand the business-business relationships, mechanisms for increasing efficiency, and ways to enable business to increase productivity and add value. It provides a reference point for improvements in services and the business environment. It is a vehicle for pro-poor initiatives and for linking small businesses with the market.Value chains reside at the core of high-impact and sustainable initiatives focused on improving productivity, competitiveness, entrepreneurship, and SME growth.

Value chain analysis focuses on segmenting the different activities that add value in the production and sale of a product or service. It differs from traditional industry sector analyses in many ways, including the following:

a) Value chain analysis focuses on net value added instead of overall size and gross output.

b) Traditional industry sector analyses often do not sufficiently determine the distribution of value added between activities, both within and between countries, or a country’s current insertion in local markets.

c) Value chain analysis thoroughly examines information flows among actors in the value chain unlike typical industry analysis.

d) Segmenting the value chain allows for better understanding of the constraints and opportunities within each segment, as well as the context in which the chain operates.

Segmenting the value chain allows for better understanding of the constraints and opportunities within each segment, as well as the context in which the chain operates.

There are many ways to analyze or evaluate a value chain. Analysis can stem from research of secondary information, such as government or industry data, to interviews with industry participants. It can also be derived from participatory market assessments and market observations.

In general, an in-depth value chain analysis considers the following:

1. What are the economic costs along the value chain?

2. Where is the most value added to the value chain?

3. Who are the most import actors within the value chain?

4.What is the institutional framework of the value chain?

5. Where are the bottlenecks in the value chain?

6. Where is there market potential for growth?

7. What is the size of the sector/chain?

8. What is the potential for upgrading?

9. What possible synergies exist?

Limitations of Value Chain Analysis

As mentioned, there are many ways of analyzing a value chain. For example, value creation can be disaggregated between each link in the chain, as well as within each link. Some chains are merely a directional map , which is, in itself, valuable for beginning to understand the actors and processes that intervene to create value for particular consumers. However, agencies and other sponsors that commission value chain analysis often find that the analysis as implemented is insufficient and cannot be used to guide them in making informed decisions—particularly in deciding on actions that will greatly impact value added, rather than merely reducing costs.

Indeed, many of these analyses have a common weakness: the tendency to focus excessively on cost efficiency or breakouts of cost components. While efficiency in production is increasingly becoming a necessary condition for penetrating global markets, it will not ultimately determine sustained participation and increased incomes for value chain participants.

The following are examples of some related analytical weaknesses and challenges:

a. Value chains are not fixed or static

It is important to recognize that value chains are not fixed in terms of composition, relationships, or market positioning, and that there is a competitive need to alter and improve the value chain in light of strategic choices that businesses can make regarding the markets in which they compete. While a value chain’s purpose is to link production to the target market advantageously, it is the private sector that decides which markets and where to compete – and alters the value chain accordingly. Value chain analysis too often focuses simply on improvements within the given value chain, rather than on how value chains can be shifted to target different, more attractive markets and business strategies.

b. Market dynamics matter

Value chains can be helpful instruments for serving the needs of a particular market sector, but focusing on a static value chain can also mask the need to segment and customize products for different markets. The key elements of building sustainable competitiveness are a solid understanding of market dynamics and a thorough analysis of the attractiveness of potential market segments and the competition. Businesses must choose which products and which markets can be served competitively and base their goals and strategy on good market analysis.

c. Quality and service are also important

Similarly, excessive focus on delivering a product (especially a commodity) may hide opportunities to deliver a package of products and services that the market or customer will find desirable. Too often, a value chain analysis is not designed to help businesses and planners weigh choices about delivering product quality, information, and service.

d. Considering the environment in which a value chain operates

Often, value chain analysts fail to properly consider the business environment in which the value chain operates. In doing so, the analysis can fail to identify potential interventions for improved business and value chain performance. Government regulations, international standards and agreements, and market forces typically shape the business environment.

e. A simple cost analysis will not do

Certain value chain analyses merely depict a cost build-up per activity in producing a value chain without mapping the actors involved or identifying the value that is captured at each link of the chain. The cost build-up, and benchmarking it against competitors, will obviously provide ideas on areas for improvement. But the analysis will probably not shed light on which activities generate more value, whether the product can be produced at a competitive price for other markets, how well the chain is integrated, or how easily information flows throughout it. More importantly, a

f. Shifting value within a value chain, rather than creating more value

As mentioned earlier in this section, donor agencies and governments have sometimes used value chain analysis to identify and protect threatened links along chains. Additionally, some stakeholders continue to look at value chain analysis as a zero-sum game focused on shifting value from one link of the chain to another. This cutthroat perspective obscures opportunities to upgrade the whole system to the benefit of all value chain participants.

Services Offrered

1) Contract farming / Contact farming / Collaborative farming

2) Sourcing and aggregation of Agricultural produce

3) Sorting & Grading facility

4) Warehousing & Storage of Agri produce

5) Establishing market linkages

6) Organic products sourcing for retail / Kirana

7) Establishing supply chain for Organic product

8) Cost effective (Least Landed Cost basis) backward linkages for agri products and Fruits & vegetables for Food processing industry